To improve cash flow consider how you can speed up your accounts receivable process, and incentivize customers to pay faster. One way to improve your AP turnover ratio is to increase the inflow of cash into your business. More cash allows you to pay off bills, and the faster you receive cash, the fast you can make payments. With little cash, it would be impossible to pay suppliers quickly, which would then result in a low A/P turnover. Overall, it is beneficial to analyze these two ratios together when conducting financial analysis.

Record to Report

A high AP turnover ratio demonstrates prompt payment to suppliers, which can strengthen relationships and potentially lead to more favorable pricing terms. A low ratio, however, may signal ineffective vendor relationship management and could harm partnerships. The AP turnover ratio is a valuable tool for analyzing a company’s liquidity and efficiency in managing its payables.

You’re our first priority.Every time.

Furthermore, a high ratio can sometimes be interpreted as a poor financial management strategy. For instance, let’s say a company uses all its cash flow to pay bills instead of diverting a portion of funds toward growth or other opportunities. Calculating the AP turnover in days, also known as days payable outstanding (DPO), shows you the average number of days an account remains unpaid. The formula for calculating the AP turnover in days is to divide 365 days by the AP turnover ratio.

Excel Report Templates: Build Better Reports Faster

Monitor expenses as a percentage of revenue to ensure you’re not overspending in any one area. And use Mosaic’s income statement dashboard to proactively monitor your AP turnover by summarizing your revenue and expenses during a certain period of time. You’ll see whether the business generates enough revenue to pay off debt in a timely manner.

- A higher accounts payable turnover ratio is almost always better than a low ratio.

- When she’s not writing, Barbara likes to research public companies and play Pickleball, Texas Hold ‘em poker, bridge, and Mah Jongg.

- If a company has a low ratio, it may be struggling to collect money or be giving credit to the wrong clients.

- Let’s consider a practical example to understand the calculation of the AP turnover ratio.

- You’ll often have invoices for each of these accrued expenses, but in some cases, you might not.

- When viewing this report, you’ll know right away which invoices must be paid first, and you can plan your cash outlays accordingly.

Your AP aging report helps you see the status of your unpaid invoices and outstanding payments. The report lists all your company’s unpaid invoices, grouped by their due dates and how long they’ve been outstanding. Automated AP systems can easily identify opportunities for early payment discounts. Companies can leverage these discounts to reduce costs and improve their AP turnover ratio by paying quickly and more efficiently. Manual AP processes are prone to errors, which can delay payments and adversely affect the AP turnover ratio.

Like other accounting ratios, the how to start a bookkeeping business 2023 guide provides useful data for financial analysis, provided that it’s used properly and in conjunction with other important metrics. Accounts payable turnover ratio is a helpful accounting metric for gaining insight into a company’s finances. It demonstrates liquidity for paying its suppliers and can be used in any analysis of a company’s financial statements. However, a low accounts payable turnover ratio does not always signify a company’s weak financial performance. Bargaining power also has a significant role to play in accounts payable turnover ratios. For example, larger companies can negotiate more favourable payment plans with longer terms or higher lines of credit.

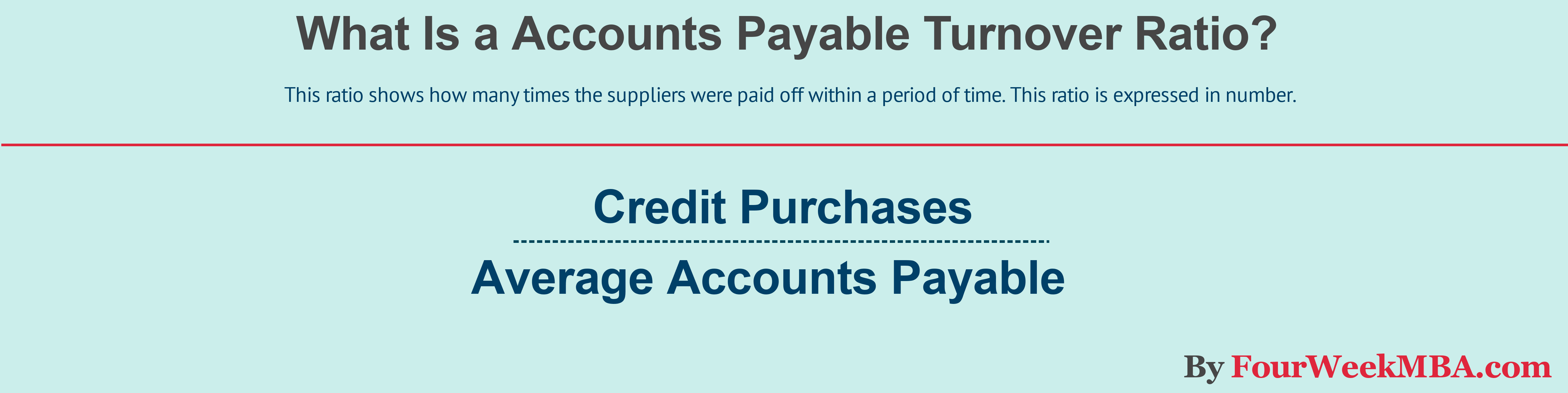

The basic formula for the AP turnover ratio considers the total dollar amount of supplier purchases divided by the average accounts payable balance over a given period. The result is a figure representing how many times a company pays off its suppliers in that time frame. You can automatically or manually compute the AP turnover ratio for the time period being measured and compare historical trends. The AP turnover ratio provides important strategic insights about the liquidity of a business in the short term, as well as a company’s ability to efficiently manage its cash flow. The Accounts Payable Turnover Ratio is a crucial financial metric that measures the efficiency with which a company is managing its accounts payable. A high ratio indicates good creditor payment policies and procedures, which can lead to better supplier relationships, access to credit and financing, and improved financial health.

Remember, the decision to increase or decrease the AP turnover ratio should be based on the specific circumstances and financial goals of the company. It’s essential to strike a balance between maintaining good relationships with suppliers and managing cash flow effectively. A high Accounts Payable Turnover Ratio is an indication of a company’s financial health and creditworthiness.

A high Accounts Payable Turnover Ratio can help healthcare providers negotiate better prices and payment terms with their suppliers, which can ultimately lead to cost savings for patients. You can use the figure as a financial analysis to determine if a company has enough cash or revenue to meet its short-term obligations. Now that you know how to calculate your A/P turnover ratio, you can try to improve it by following our tips below. But in the case of the A/P turnover, whether a company’s high or low turnover ratio should be interpreted positively or negatively depends entirely on the underlying cause.

With this data at your fingertips, cross-departmental collaboration becomes more productive, allowing you to identify opportunities to improve efficiency and AP turnover to help the business grow. A low ratio may indicate issues with collection practices, credit terms, or customer financial health. Automation can speed up your AP process, as well as keep you up-to-date on payments, due dates, and a centralized place for all your bills.